Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

2008 Financial Crisis And The Death Of The Real Economy

- Creation of zombie economy

- Low interest rate regime

- Cash generation excess

- Loss of productivity in western economies

3

15 reads

The background

- 1933 glass stiegel act reversed in 1999

- == converging banks and investment cos

- 1999 stock bubble Qualcomm 2600% 1y

- 2001 9/11 attacks

- 2001 Enron financial debacle

- 2002 shift to real estate investment

3

6 reads

Financial engineering

- CDO collateralised debt obligations

- CDS credit default swaps

- Insure CDO risk ; extreme specialty; OTC; sold by risk owner

- 2008 60 tn USD CDs

- AIG Fannie Mae big buyers

- Financial leverage / capital adequacy

3

5 reads

Real estate bubble

- funding non income individuals with mortgages ;

- Mc Donald's worker with 6 homes

- sub prime lending

- Mortgage backed securities

3

8 reads

Build up

- 2004 Collapse // Morgan Stanley

- 4.1 tn USD debt 30% us economy

- Reset rates 2-3 years // foreclosure

- 1.3 million foreclosure 2007

- Eo 2007 2.3 million homes foreclosure

- Sub prime lender closure

3

5 reads

The crash

- Bnp Paribas/ no liquidity in the market

- Uk bank Northern rock ; first bank run since 1866

- Bear Stern's mar-2008 13.4 tn USD market value / 5th largest

- Alan Schwartz CEO

- 170 - 2 $ in 3/4 weeks

- Lehman brothers / Erin CFO / risk 30x capital / June 2.6 BN $ loss

- Goldman Sachs bets against mbs

- 2008-09 Lehmann bankruptcy after 158y

- 2009-0915 manic Monday Dow 500 points

- Merill lunch ma with bank of america

- Banking freeze / Harvard couldn't pay wage bills

3

2 reads

The Afterma

- AIG = gov.us bail out 180 bn$

- Occupy Wall Street

- Crypto currency genesis

- 2.5tn $ debt purchase

- By mid 2009 50% equity market collapse

3

4 reads

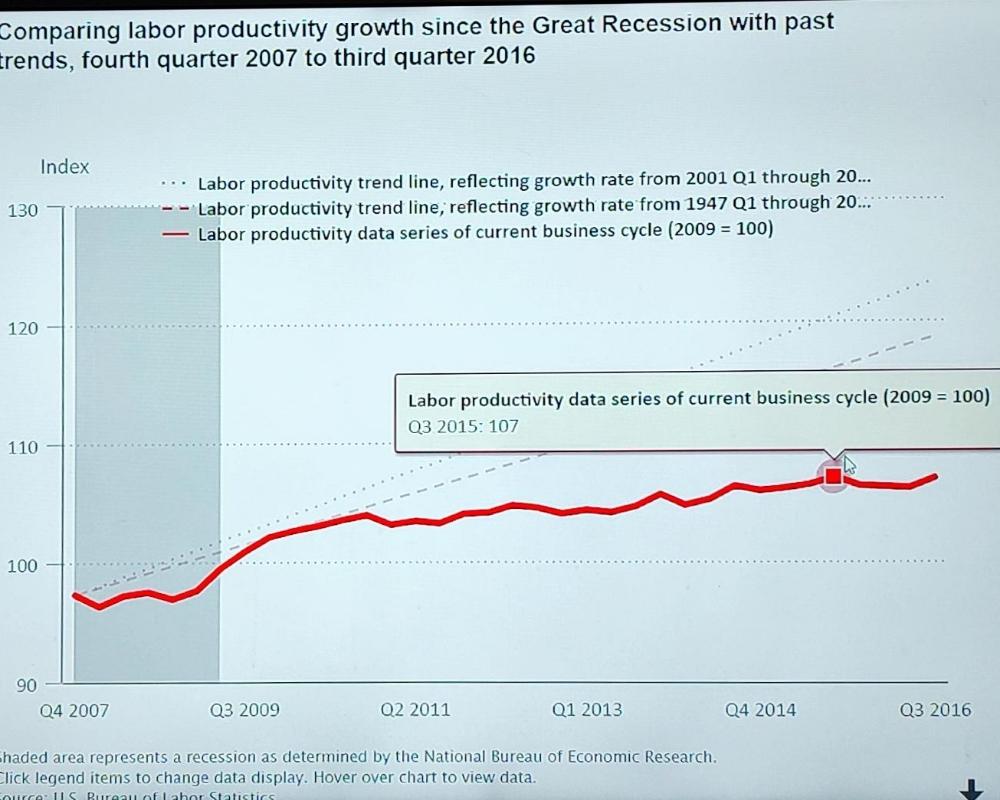

Long Term Effects

- European debt crisis 2009 - 2020

- Pigs : country crisis

- 2009-0410 / declare crisis is over

- 10% unemployed ; 6 million jobs; 8 million foreclosure

- 2010 Dodd Frank act ; regulation ;

- Bcso / bespoke collateralised security obligations

- 40tn $ on corporate debt

3

2 reads

Long Term Structuring

- Cash infusion by governments ; the easy path

- Quantitative easing

- Riots in Greece

- Iceland : systemic collapse 80% stock collapse

- Landbankinn - glitnir ; 3 large banks; 12x GDP

3

3 reads

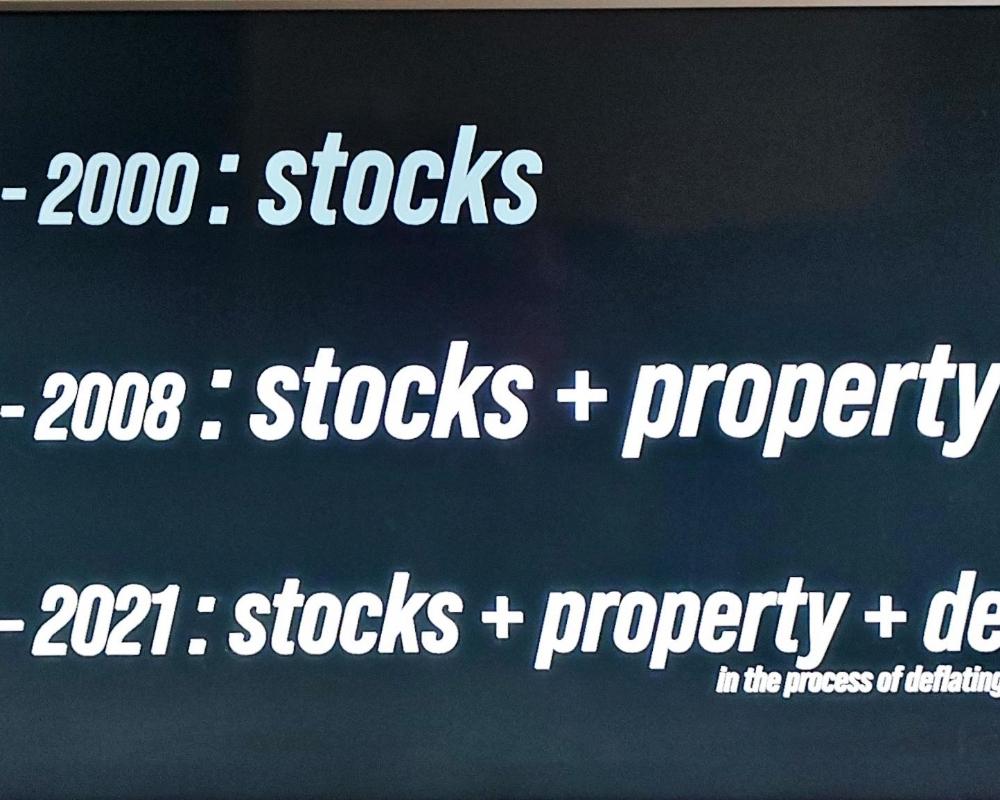

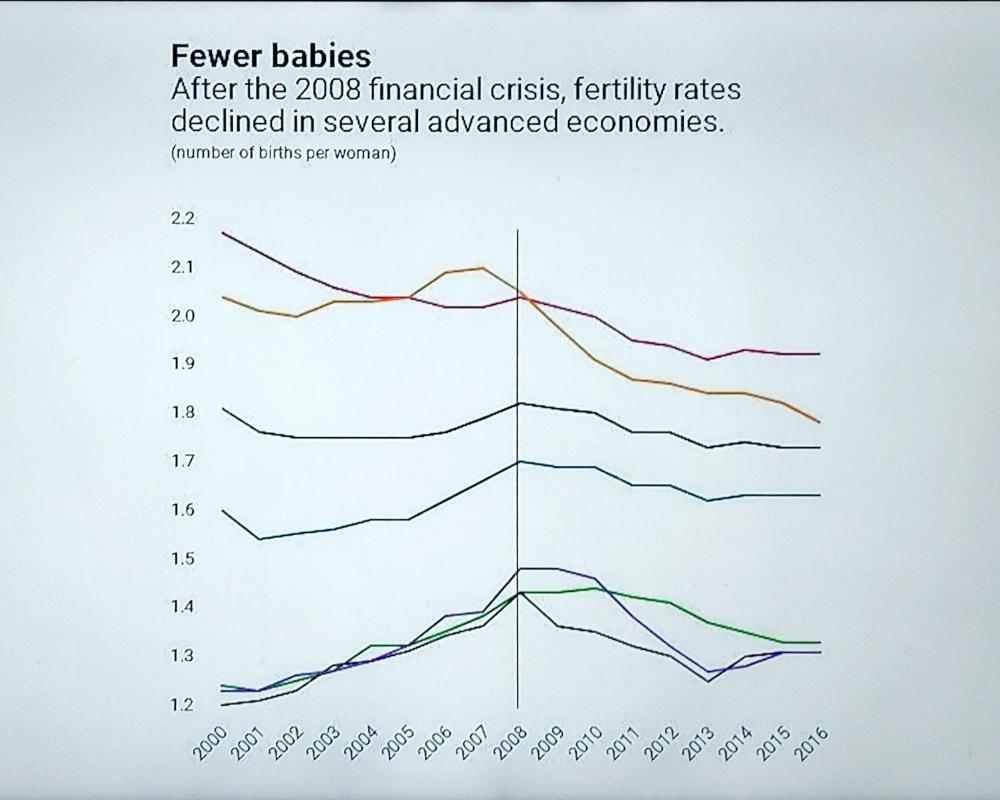

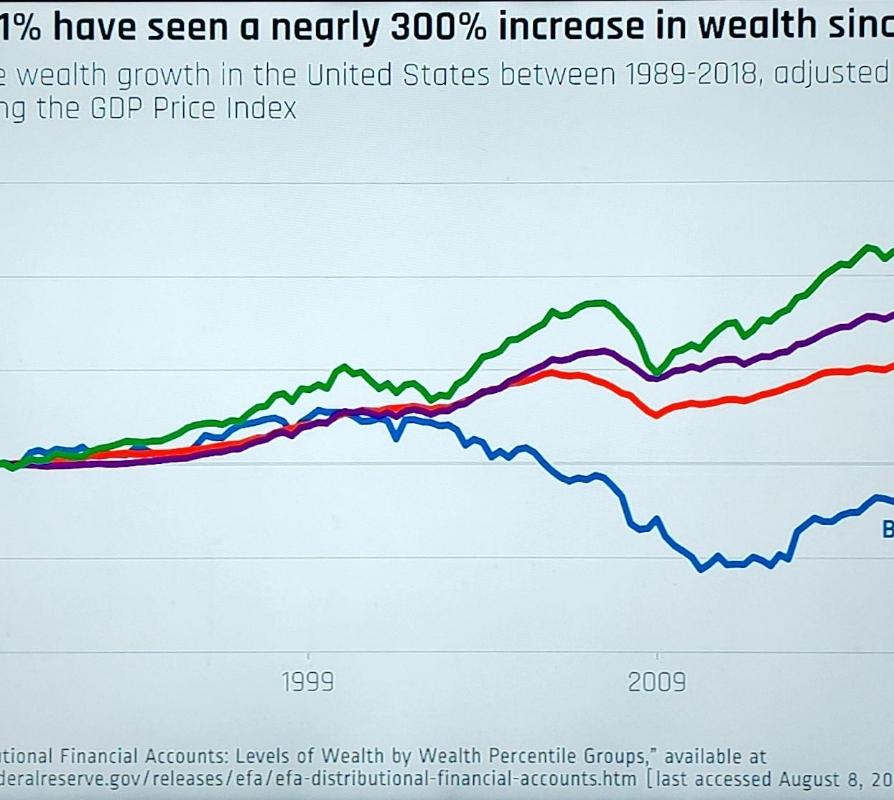

Death of the real economy

- Millennials are poor than their parents

- Dropping fertility rates

- Low interest rate regime .. cheap money

- Scaffolding: Low rate + excess cash

- == disparity in population

3

3 reads

Pandemic And Acceleration

- 2020- pandemic cash surge

- Jeremy Siegel was monumental mistake

- Risk assets Like nfts

3

3 reads

Post Pandemic Geopolitics

- 2021 Inflation surge

- 2022 Variable rate mortgages in Canada Australia UK will reset rates in next 1-2 years

- 2022 Credit Suisse crisis

- russia Ukraine war disrupts commodities

- China zero COVID disrupts supply chain

- Weakening $ with multilateral local currency trading RSA brics China India russia

3

2 reads

How to avoid risk / anti-fragile

- Gold silver cash government bonds

- Long term investment into innovation

- Minimal simplify expenditure

- independent life style

3

3 reads

IDEAS CURATED BY

CURATOR'S NOTE

2008 financial crisis and impacts on real economy

“

Vishwanath Gopu Ramdas's ideas are part of this journey:

Learn more about career with this collection

How to synthesize information from multiple books

How to analyze a book

How to set reading goals

Related collections

Similar ideas

3 ideas

Jordan Peterson with Robert Breedlove discussing fiat & bitcoin

Robert Breedlove

4 ideas

Can We Make Better Tutorials for Complex Games?

Game Maker's Toolkit

1 idea

21 Tiny Habits to Improve Your Life in 2021 Effortlessly

The Art of Improvement

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates