Startup Equity Split: How to Distribute Equity the Right Way

Curated from: cakeequity.com

Ideas, facts & insights covering these topics:

8 ideas

·1K reads

11

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

What is Startup Equity?

The term startup equity refers to the ownership of a startup, usually demonstrated as a percentage of ownership (or shares) given to individuals that contribute to the growth of a business. These could be your co-founders, investors, employees, and even experienced advisors.

14

203 reads

Fun Fact

Fun fact: Did you know that Jeff Bezos, the 4th richest person alive and the CEO of Amazon, owns less than 10 percent equity in Amazon, a company he founded? 😉

13

193 reads

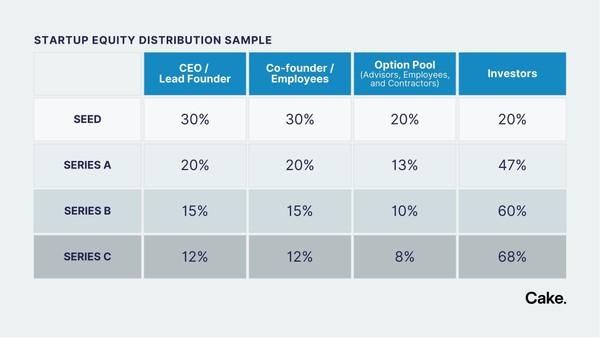

Who gets equity in a startup?

When your startup is in the initial stages, the founder or the co-founders usually own it entirely, typically in a 50/50 split, or 60/40, depending on various conditions.

As you grow, equity is distributed among those who contributed to fund your startup, give you advise, or develop your product/service offerings:

- Co-founders that invested into the vision or business idea.

- Friends or family members who contributed seed money.

- Employees who invested their time and skills.

- Advisors who gave expert advise or network.

- Investors who provided capital.

- Other service providers.

16

127 reads

Factors to consider when splitting startup equity (1)

Contribution. One of the most common factors to consider when splitting equity is the relative contribution of each founder, advisor, or employee. This can include things like the time and effort that each one puts into the company, the expertise they bring to the table, and any intellectual property they contribute.

14

117 reads

Factors to consider when splitting startup equity (2)

Roles and responsibilities. Founders should consider the roles and responsibilities of each team member when determining equity splits. For example, a founder who is taking on a key leadership role or an employee who has a more specialized skill set may be entitled to a larger share of the equity.

14

95 reads

Factors to consider when splitting startup equity (3)

Future plans. Founders should also think about long-term goals and how equity splits may impact those plans. For example, if one founder plans to take on a full-time role with the company while the other intends to remain a passive investor, this may affect equity split.

14

99 reads

Factors to consider when splitting startup equity (4)

Market conditions. The state of the market and the industry in which the company operates may also influence equity distribution. Say, if a company is in a highly competitive market or seeking future funding from external investors, the founders need to give a larger share of equity in order to secure necessary capital.

14

76 reads

Factors to consider when splitting startup equity (5)

Legal and tax considerations. There may also be legal and tax implications to consider when splitting startup equity. For example, founders may want to consult with a lawyer or accountant to understand the tax implications of different scenarios to ensure that the company is structured in the most tax-efficient manner possible.

14

90 reads

IDEAS CURATED BY

CURATOR'S NOTE

Because we don't think about how to distribute equity in a startup until is late and when it is complicated to change things.

“

Ruben Lozano's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to create customer-centric strategies

The importance of empathy in customer success

The impact of customer success on business growth

Related collections

Similar ideas

3 ideas

Equity for Startups Employees

medium.com

11 ideas

9 ideas

A Guide to Finding Awesome Co-Founders

medium.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates