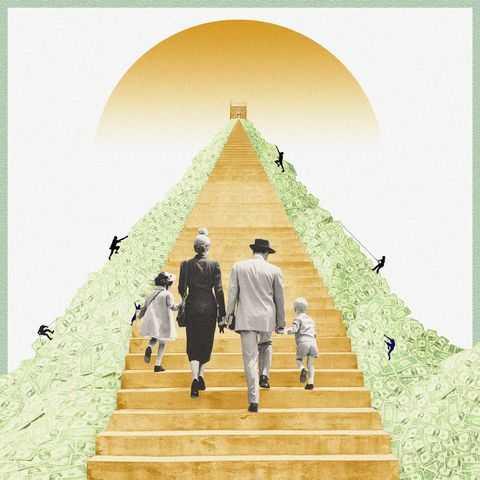

Why Does It Feel Like Everyone Has More Money Than You?

Curated from: harpersbazaar.com

Ideas, facts & insights covering these topics:

2 ideas

·853 reads

4

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Self-Made Millennials

Millennials who claim to be ‘self-made’ get support from their parents and in some cases, enjoy the privilege too, but are reluctant to admit the same. They have to show the world that they are able to do well and sustain themselves on their own, and any conversation around money, privilege, success and class stirs up topics they may try to avoid.

Gender Bias: Women who inherit from their parents and do well are looked upon differently than men who do the same.

43

432 reads

The Truth About Millennial Money

- It’s important to share your real struggles, support and fundings once you find success, or it gives a distorted and false impression to those struggling without any resources. There shouldn’t be a stigma attached to getting help from parents and spouses.

- It’s imperative to have transparency about money and understand that in any structure of privilege, the people at the top have to take into account what it means to people below them, who are struggling with meagre resources or a network of supporters.

55

421 reads

IDEAS CURATED BY

Summer S.'s ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to find purpose and meaning in life

How to cultivate gratitude

Techniques for managing negative thoughts

Related collections

Similar ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates