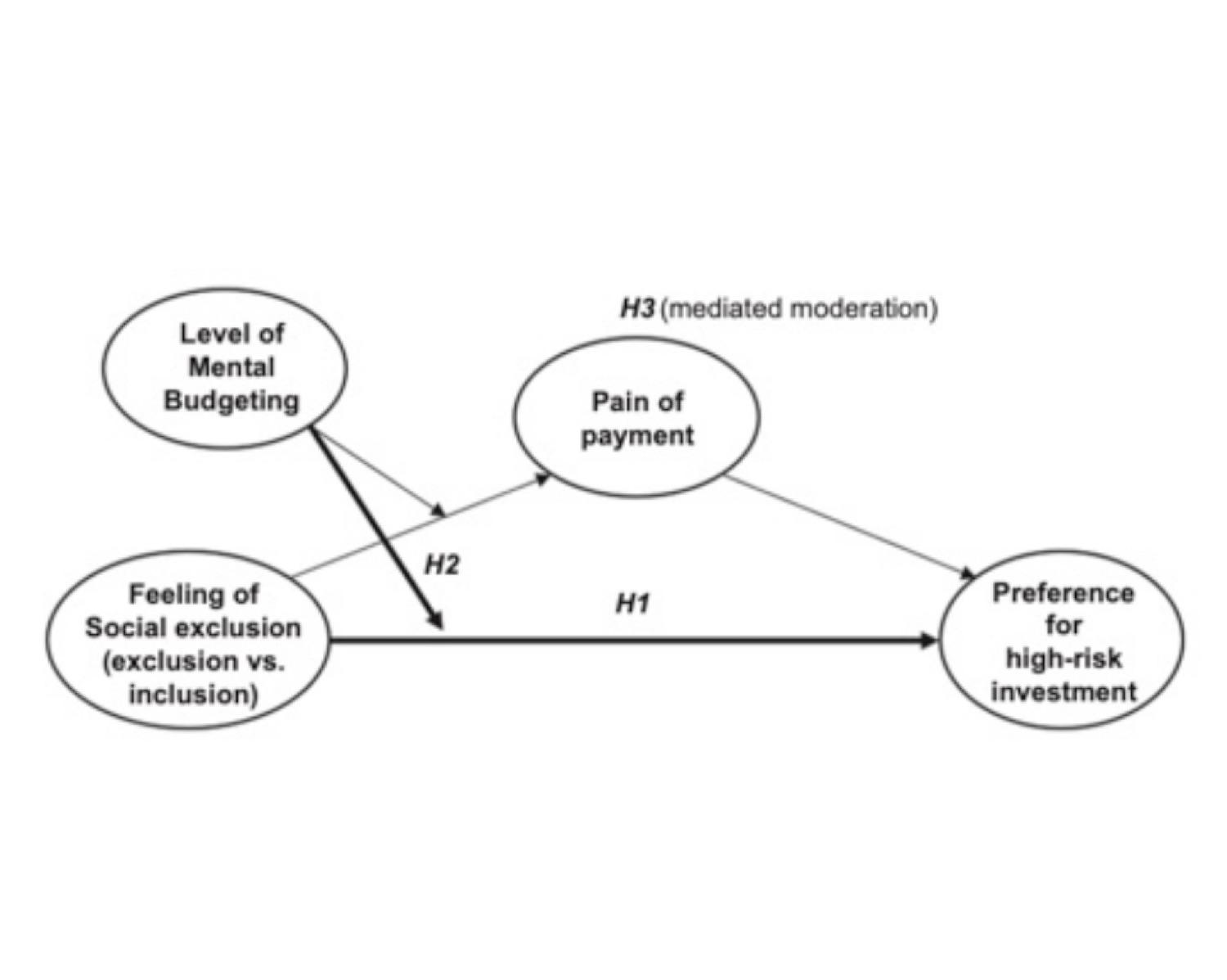

Hypotheses

H1: Socially excluded people have a higher preference for high-risk investment products than socially included people.

H2: For individuals with higher mental budgeting, the positive effect of social exclusion on preference for high-risk investment products will be lower.

H3: The moderating effect of mental budgeting on the impact of social exclusion on consumer preference for high risk investment is mediated by pain of payment.

9

87 reads

The idea is part of this collection:

Learn more about psychology with this collection

How to overcome fear of rejection

How to embrace vulnerability

Why vulnerability is important for personal growth

Related collections

Similar ideas to Hypotheses

Soya studies

It’s difficult to isolate soya’s benefits conclusively:

- No one has given people soya foods, then looked at whether they’re more or less likely to get breast cancer over time than those not given soya.

- One review of evidence into soya's effect on breast cancer risk found studies...

How to Shop Smart

- Evaluate purchases by cost per use. Higher cost products may last longer, but go unconsidered because of their initial price.

- Spend on experiences, not things, as they give you more happiness for your investment.

- Shop solo to avoid buying unnecessary thin...

Types of product adopters

There are different types of adopters at each product stage:

- innovators: like taking high risks and have a good discretionary income. Naturally knowledgeable in the product space. Marketing and UX teams should identify them before launch to design for mass scale

- early adopter...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates