The effects of mental budgeting and pain of payment on the financial decision making of socially excluded people

Curated from: emerald.com

Ideas, facts & insights covering these topics:

6 ideas

·749 reads

2

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Summary

The study found that consumers experiencing social exclusion are more likely to make high risk investments. This effect is moderated by consumers' level of mental budgeting such that at high levels of mental budgeting the effect of social exclusion on investment choice is attenuated. The study further finds that the moderating effect of mental budgeting is mediated by pain of payment.

The findings suggest that policymakers can reduce unduly risky personal investment behavior by triggering mental budgeting thoughts using methods such as advertising and mention of transaction fees.

10

176 reads

Social exclusion

- a state of physical/emotional isolation involving feelings of loneliness due to being left out, ignored or ostracised by others

- leads to anti-social behaviour

influences:

- preference for distinctive products: psychological emptiness/ unsatisfactory interpersonal relationships intensify the desire for material possessions and conspicuous consumption

- risk-taking behaviour: present-day bias, less conservative investment behaviour

- inclination towards brand/ product switching (self-efficacy, sense of control)

- financial literacy is lower in developing countries; lowest w.r.t. risk diversification

10

178 reads

Mental Accounting

- incl. mental budgeting (separation of monetary income into economic categories), labelling of income and assets, hedonic framing (evaluation of gains and loss combinations)

- violates the fungibility assumption of money: different propensities to use money depending on the source

- hampered by credit card use: decouples costs and benefits by facilitating mixing of purchases among budgeted categories and increasing temporal distance between purchases and payments (payment delayed until credit card bill is due)

10

121 reads

Mental Accounting II

- prospect theory: loss perception decreased in consumers in a low state of mental budgeting

- psychological myopia: tendency to focus on immediately relevant information (e.g., transaction fees) while ignoring relevant background information stronger for high levels of mental budgeting ➡️ lower probability of engaging in high-risk investments

9

95 reads

Pain Of Payment

- painful state of mind or psychological burden consumers experience upon purchase

- lowered by credit card and mobile payments

- bottom dollar effect: purchases using budgets close to exhaustion result in a lower customer satisfaction

- higher level of mental budgeting results in stronger pain of payment

9

92 reads

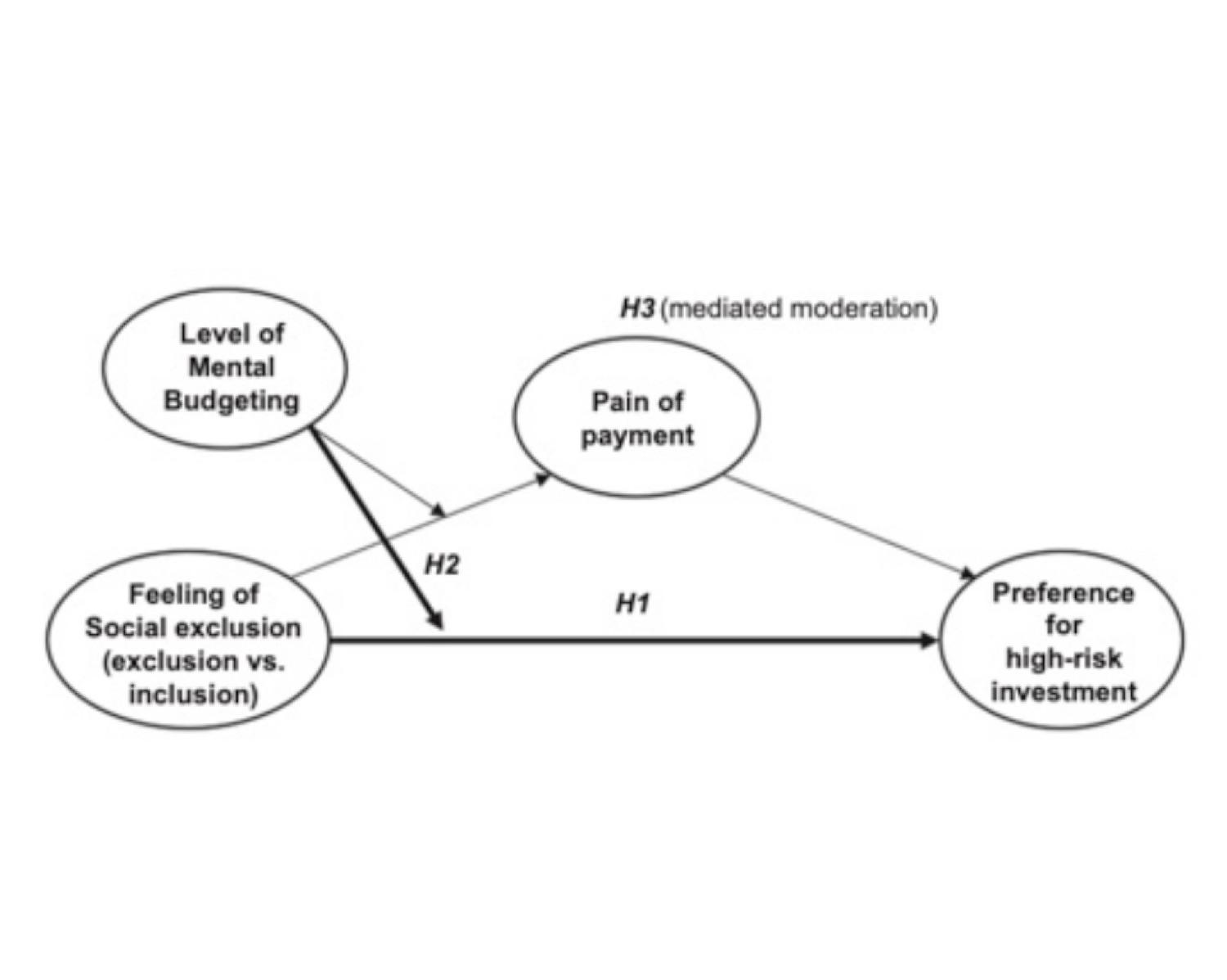

Hypotheses

H1: Socially excluded people have a higher preference for high-risk investment products than socially included people.

H2: For individuals with higher mental budgeting, the positive effect of social exclusion on preference for high-risk investment products will be lower.

H3: The moderating effect of mental budgeting on the impact of social exclusion on consumer preference for high risk investment is mediated by pain of payment.

9

87 reads

IDEAS CURATED BY

Anne Marie's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to overcome fear of rejection

How to embrace vulnerability

Why vulnerability is important for personal growth

Related collections

Similar ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates