Don't lend money you don't have

If you can't afford to help, say no. Your job is to make sure you're on track to achieve your own financial goals.

No one will care more about your money than you.

27

281 reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about loveandrelationships with this collection

Cultivating self-awareness and self-reflection

Prioritizing and setting boundaries for self-care

Practicing mindfulness and presence

Related collections

Similar ideas to Don't lend money you don't have

Do you have a financial plan?

- When you decide to do freelance writing full-time, income stability is often the tradeoff. To hedge risk (as investors would say), save at least three months of living expenses saved up before quitting your day job — this will offer some relief during slow months and emergencies.

- Mak...

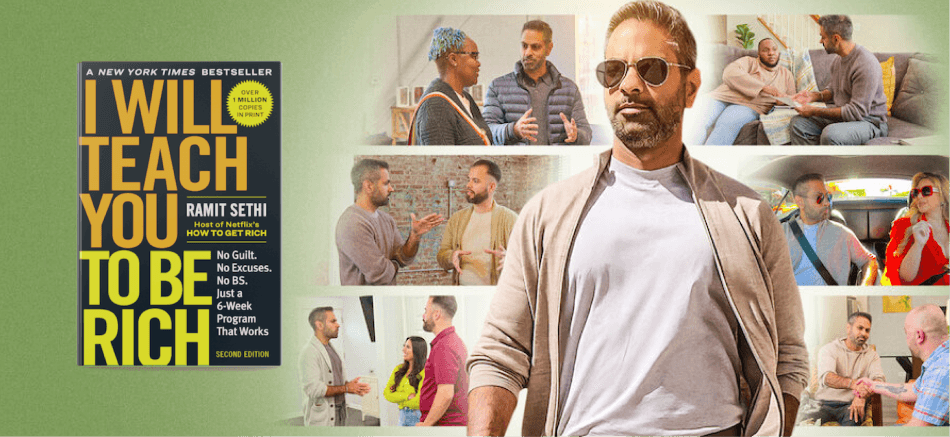

Anyone Can Become Rich

This is the main premise of the best selling book by Ramit Sethi. He structures his ideas into 4 buckets:

- Track your spending. This will help you see where your money is going and identify areas where you can cut back.

- Set financial goals

A Monthly Budget For Your Money

No matter how little or how much money you earn, creating a monthly budget is one of the most important aspects of managing your finances. What gets measured gets managed.

Having a budget doesn't stop you from spending money the way you want it to, but works like a partne...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates