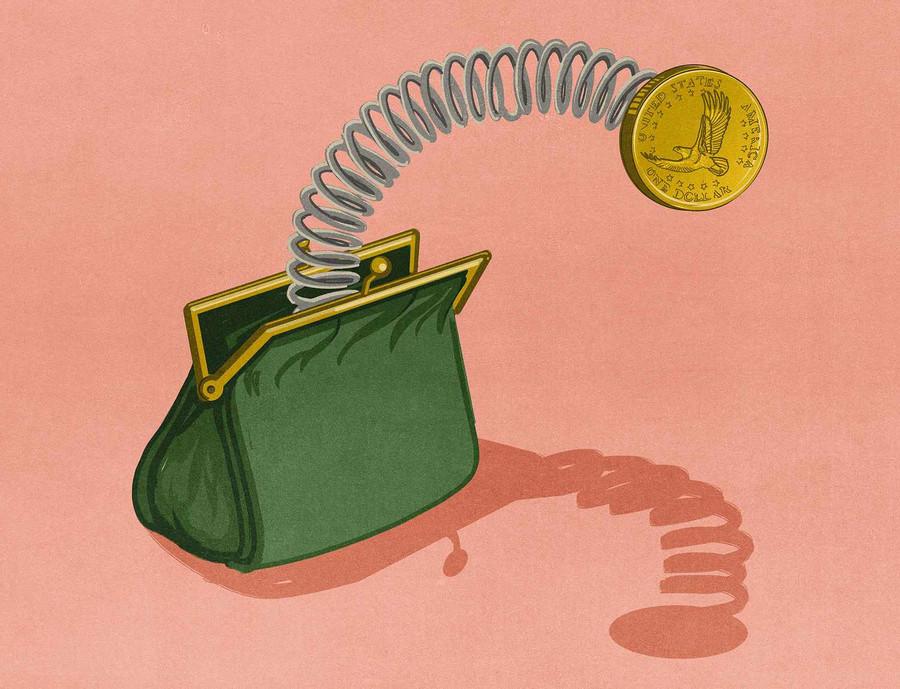

How to Lend Money to Family Without Ruining Your Relationship(s)

Curated from: realsimple.com

Ideas, facts & insights covering these topics:

10 ideas

·2.78K reads

19

1

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Rules to follow when lending/borrowing money to family members

- The first rule to follow when lending money to a family member: Assume they will never pay you back—and be OK with that.

- And here's the first rule to follow when borrowing money from family: Pay them back.

Money always seems to get uncomfortably personal; there's a power shift in the relationship: The lender becomes more powerful—you see yourself as more responsible. That puts the borrower in a one-down position, which can breed resentment.

27

504 reads

Take time to think about it

You are under no obligation to say yes on the spot when a family member asks for money—no matter how dire their situation is.

- Say, 'I would love to be able to help you. Let me think about whether this is best for me.'

- Pause and reflect before answering. Taking even a few minutes gives you time to formulate key follow-up questions in your head.

- You need to know how much they need, why they need it, and what their income expectations are now and for the future.

- Get a sense of whether they can repay you and what their timeline is for that.

- Then take two to three days to respond.

25

380 reads

Discuss it with your partner

Before you get back to the borrower with an answer, you need to consult your partner or spouse if you have one, especially if the amount is substantial given your financial picture.

As with all difficult subjects, open communication is key, particularly if your partner isn't as willing to write a check as you are. If your partner is simply not on board with the loan, the deal is off. Marriage is a financial partnership. The partner who doesn't want to lend likely has veto power.

25

288 reads

Trust your gut if it’s telling you to say no

- Lending money is nearly always a bad idea. Anytime you can say no, do so. Even if the person pays you back, you've opened a door that will never close again. You become the bank—it changes how your relative looks at you and how you look at them.

- The experts agree that there are two cases in which you should refuse: if you simply can't afford it, or if the person has a history of borrowing from you or others and not repaying.

- You probably won't feel awesome after refusing the loan. Own those feelings. Then tell them, 'For me, right now, this is the best decision.'

25

280 reads

Don't lend money you don't have

If you can't afford to help, say no. Your job is to make sure you're on track to achieve your own financial goals.

No one will care more about your money than you.

27

281 reads

Do offer to help in other ways

Focus on your loved one's underlying financial issue and see if you can help address it. Help them find the resources they need or create a budget.

Addressing the underlying issue doesn't just benefit your cash-strapped family member. It also helps you, by ensuring they don't come knocking on your door in six months, looking for more money.

25

253 reads

Feel good about giving this gift

Yes, "gift." There's no other way to look at it, agree McCoy, Castro, and Hendershott: When you lend money to someone—even your closest, most trustworthy sibling—you must assume they will never pay you back and make your peace with that. "It would be nice to think they can and will repay you, and lots of people do," says Castro. "But if you think of the money as a gift, you will be free of any resentment or weird feelings the next time you see them at a family party. It's better for you to continue in your life without holding a grudge."

24

223 reads

If you’re hoping to borrow, come armed with a payback plan

Just because potential lenders should think of the loan as a gift doesn't mean borrowers should treat it as such. When you ask someone you love and trust to give you their money, it's a sign of respect to present a thought-out repayment schedule.

Have a real conversation about how the loan will get repaid and when. Once you start talking about money, it only takes about five minutes for the conversation to become less awkward, and you can talk about it like the numbers on paper that it really is.

Putting the loan terms in writing can go far to promote peace of mind and reduce resentment.

24

208 reads

Withhold judgment

Lending money to a relative does not give you a free pass to criticize their spending going forward.

Let them be free to do whatever they want with the money, and don't judge them for it. You need to see that person on their own journey and bring compassion, love, and acceptance to the table.

The best way to let go of toxic, judgmental feelings is to remind yourself you gave a gift, not a loan—even if it appears your child is blowing your "gift" on new shoes.

26

181 reads

Stick to the payback plan—or revise it if needed

When you ask a family member for a loan, treat it as a loan. Adhere to the payback schedule. And if you can't, start looking at plan C (because borrowing from a family member was already plan B).

Renegotiate the terms with your relative so you can keep your promise to pay. If that's not enough, get a part-time job, sell some physical belongings, ask for a raise. You'll be glad you did, for the sake of your relationship with your family—and your peace of mind.

24

190 reads

IDEAS CURATED BY

Holden O.'s ideas are part of this journey:

Learn more about loveandrelationships with this collection

Cultivating self-awareness and self-reflection

Prioritizing and setting boundaries for self-care

Practicing mindfulness and presence

Related collections

Similar ideas

12 ideas

12 Great Money Rules Your Parents Should’ve Taught You

financebuzz.com

3 ideas

Everything you need to know About DeFi Loans

101blockchains.com

8 ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates