Start Your Journey

- Save up an emergency fund equal to at least three months of your living expenses.

- Create a debt repayment schedule that pays down your debt at a minimum cost of interest and maximum benefit in profit to you. Compare the interest on your debt with the return on investment you are getting per dollar for the month.

- Open up a retirement account.

- Consider investing in the likes of mutual and index funds because they are low-risk.

- Consider investing in the individual stocks of companies you feel a strong affinity for (only if you feel confident of your investing savviness).

194

1.8K reads

CURATED FROM

IDEAS CURATED BY

A junior reader who enjoy topics that advocate for self-improvement. Also a proponent of healthy living and mindfulness (still learning). Let’s connect and explore the world of books together!

Having a written financial plan gives us a measurable goal to work toward. We can reduce doubt or uncertainty about our decisions and adjust to help overcome obstacles that could derail us.

“

The idea is part of this collection:

Learn more about habits with this collection

How to build confidence

How to connect with people on a deeper level

How to create a positive first impression

Related collections

Similar ideas to Start Your Journey

Focus on...

- Building an emergency fund: set up an automatic weekly or monthly transfer from your checking account to your savings, then leave the savings alone until an emergency appears.

- Eliminating high-interest debt: Set up a simple debt repayment plan by organizing your debts b...

20%: Savings

Finally, try to allocate 20% of your net income to savings and investments. This includes adding money to an emergency fund in a bank savings account, making IRA contributions to a

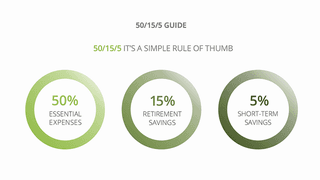

The 50/15/5 rule for multiple financial goals

- 50% of your income goes toward essential expenses: rent, bills, minimum debt payments.

- 15% percent goes to retirement savings. They also suggest you increase this by 1% each year.

- 5% goes toward unexpected monthly expenses or building an emergency...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates