Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

1. Growth

- MRR or ARR: For startups seeking a Series A funding round, the old benchmark used to be $1 million in ARR. But recently, the threshold has been around $500k ARR, as rounds get preempted and happen earlier.

- Compound Monthly Growth Rate (CMGR): For startups seeking Series A or B funding, we like to see a CMGR of at least 15% below $1M ARR and 10% above $1M ARR. A CMGR of 10% is about 3x year-over-year growth.

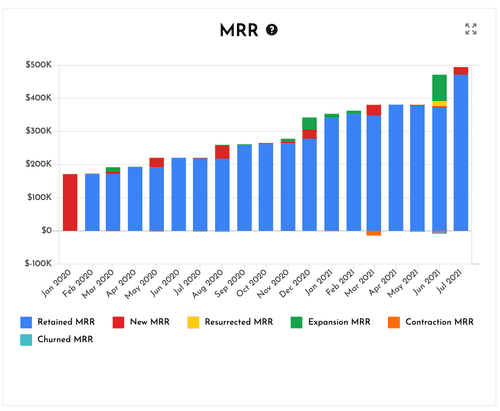

- MRR Components: Retained MRR / New MRR / Resurrected MRR / Expansion MRR / Contraction MRR / Churned MRR

- Customer Concentration: Is growth driven by a few big contracts or many small ones?

19

83 reads

2. Retention

- Dollar Retention / Net Revenue Retention (NRR): measures how much revenue a cohort is generating in each period relative to its original size.

- Logo Retention: measures the percent of customers that stay active (non-churned).

Logo Retention is typically a function of customer size: 90-95% is common for enterprises, 85% for mid-market, and 70-80% for small businesses.

Dollar Retention is much more important than Logo Retention.

18

126 reads

3. Sales Efficiency / Unit Economics

- New Sales ARR vs S&M Expense: How much did S&M departments (all programs and personnel) spend vs how much New Sales ARR was added in the same period.

- CAC: divides S&M expense in the preceding period (month or quarter) by the number of new customers in the current period.

- New ACV vs CAC: It’s useful to compare Annual Contract Value (ACV) of new customers to their CAC. Ideally, ACV is greater than CAC.

- CAC Payback: divide S&M spend by MRR x Gross Margin.

- Magic Number: the Net New ARR in a period divided by S&M expense from the prior period. Ideally, the ratio is > 1.

18

19 reads

4. Margins

- Gross Margin: reflects a company’s margin after subtracting the cost of goods sold (COGS) from revenue. In the long-term, SaaS companies should have a Gross Margin of at least 75%.

- LTV: is the cumulative gross profit contribution, net of CAC, of the average customer in a cohort. Therefore, LTV incorporates CAC, Dollar Retention, and Gross Margin to show overall company health. Healthy cohorts cross the $0 LTV line before month 12, and LTV grows to at least 3x original CAC over time.

18

16 reads

5. Capital Efficiency

- Burn Multiple: a company’s Net Burn divided by its Net New ARR in a given period. For fast-growing SaaS companies, a Burn Multiple of less than one is amazing, but anything less than two is still quite good.

- Hype Ratio: Capital Raised (or Burned) divided by ARR.

18

37 reads

6. Engagement

- DAU/MAU: A good metric for most SaaS startups is 40% DAU/MAU during non-holiday weekdays.

- DAU/WAU: A good metric for most SaaS startups is 60% DAU/WAU during non-holiday weekdays

19

53 reads

IDEAS CURATED BY

Dan Ciotu's ideas are part of this journey:

Learn more about strategy with this collection

How to start a successful business

How to build a strong team

How to market your business

Related collections

Similar ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates