Logan 's Key Ideas from The Most Important Thing

by Howard Marks

Ideas, facts & insights covering these topics:

42 ideas

·47.9K reads

117

1

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Market Investing Basics

- Even the best investors don’t get it right every time. The reasons are simple. No rule always works.

- Psychology plays a major role in markets, and because it’s highly variable, cause-and-effect relationships aren’t reliable.

- Because investing is at least as much art as it is science, it’s never my goal – in this book or elsewhere – to suggest it can be routinized.

- One’s investment approach be intuitive and adaptive rather than be fixed and mechanistic.

- Just invest in an index fund that buys a little of everything. That will give you what is known as ‘market returns’.

539

3.99K reads

Second Level Thinking

Only a few of them will achieve the superior insight, intuition, sense of value and awareness of psychology that are required for consistently above-average results. Doing so requires second-level thinking.

Your thinking has to be better than that of others – both more powerful and at a higher level.

What is second-level thinking?

First-level thinking says, ‘It’s a good company; let’s buy the stock.’ Second-level thinking says, ‘It’s a good company, but everyone thinks it’s a great company, and it’s not. So the stock’s overrated and overpriced; let’s sell.’

553

2.96K reads

Don't Be Like The Crowd

First-level thinkers think the same way other first-level thinkers do about the same things.

All investors can’t beat the market since, collectively, they are the market.

To outperform the average investor, you have to be able to outthink the consensus. Are you capable of doing so? What makes you think so?

The problem is that extraordinary performance comes only from correct non-consensus forecasts.

The upshot is simple: to achieve superior investment results, you have to hold non-consensus views regarding value, and they have to be accurate. That’s not easy.

544

2.42K reads

538

3.79K reads

Market Efficiency

Asset prices immediately reflect the consensus view of the information’s significance. I do not, however, believe the consensus view is necessarily correct.

To beat the market you must hold an idiosyncratic, or nonconsensus, view.

The efficient market hypothesis is its conclusion that ‘you can’t beat the market.’

The greatest ramifications of the Chicago theory has been the development of passive investment vehicles known as index funds.

517

1.78K reads

Taking Risk Is.... Risky

If riskier investments could be counted on to produce higher returns, they wouldn’t be riskier.

The key question is whether it’s right: Is the market unbeatable? Are the people who try wasting their time? Are the clients who pay fees to investment managers wasting their money?

Second-level thinkers know that to achieve superior results, they have to have an edge in either information or analysis or both. They are on the alert for instances of misperception.

516

1.49K reads

The Limits Of Efficiency

Efficiency is not so universal that we should give up on superior performance.

Efficiency is what lawyers call a ‘rebuttable presumption’ – something that should be presumed to be true until someone proves otherwise.

Inefficiency is a necessary condition for superior investing. Attempting to outperform in a perfectly efficient market is like flipping a fair coin: the best you can hope for is fifty-fifty.

For investors to get an edge, there have to be inefficiencies in the underlying process – imperfections, mispricings – to take advantage of.

513

1.24K reads

Defining Value

For investing to be reliably successful, an accurate estimate of intrinsic value is the indispensable starting point. Without it, any hope for consistent success as an investor is just that: hope.

Buy at a price below intrinsic value, and sell at a higher price.

An investor has two basic choices: gauge the security’s underlying intrinsic value and buy or sell when the price diverges from it, or base decisions purely on expectations regarding future price movements.

512

1.04K reads

The Flaw Of Day Trading

Day traders considered themselves successful if they bought a stock at $10 and sold at $11, bought it back the next week at $24 and sold at $25, and bought it a week later at $39 and sold at $40. If you can’t see the flaw in this – that the trader made $3 in a stock that appreciated by $30 – you probably shouldn’t read the rest of this content.

Two approaches, both driven by fundamentals: value investing and growth investing.

515

1.05K reads

Being Right Isn't Always Easy

If value investing has the potential to consistently produce favourable results, does that mean it’s easy? No. For one thing, it depends on an accurate estimate of value. Without that, any hope for consistent success as an investor is just that: hope.

It’s hard to consistently do the right thing as an investor. But it’s impossible to consistently do the right thing at the right time.

Being too far ahead of your time is indistinguishable from being wrong.

513

933 reads

Buy It Well: The Price And The Value

- Investment success doesn’t come from ‘buying good things,’ but rather from ‘buying things well.’

- Deciding on an investment without carefully considering the fairness of its price is just as silly.

- There’s no such thing as a good or bad idea regardless of price!

- Well bought is half sold.

- There’s nothing better than buying from someone who has to sell regardless of price during a crash.

- You can’t make a career out of buying from forced sellers and selling to forced buyers.

- Since buying from a forced seller is the best thing in our world, being a forced seller is the worst.

510

877 reads

The Upside Down World Of Investing

- Investing is a popularity contest, and the most dangerous thing is to buy something at the peak of its popularity.

- The safest and most potentially profitable thing is to buy something when no one likes it. Given time, its popularity, and thus its price, can only go one way: up.

- In bubbles, ‘attractive’ morphs into ‘attractive at any price.’

- In bubbles, infatuation with market momentum takes over from any notion of value and fair price.

513

811 reads

The Heart Of The Matter

Possible routes to investment profit:

- Benefiting from a rise in the asset’s intrinsic value.

- Applying leverage.

- Selling for more than your asset’s worth.

- Buying something for less than its value.

510

876 reads

Understanding Risk

Dealing with risk is an essential element in investing. There are three reasons for this:

- First, risk is a bad thing, and most level-headed people want to avoid or minimize it.

- Second, when you’re considering an investment, your decision should be a function of the risk entailed as well as the potential return.

- Third, when you consider investment results, the return means only so much by itself; the risk taken has to be assessed as well. Was the return achieved in safe instruments or risky ones?

507

691 reads

The Probability Of Losing Money

Risk is – first and foremost – the likelihood of losing money.

The possibility of permanent loss is a risk to worry about.

- Falling short of one’s goal

- Underperformance

- Career risk

- Unconventionality

- Risk that could jeopardize return to an agent’s firing point is rarely worth taking.

- Illiquidity

511

1.09K reads

The Three Attributes Of Risk

- First, risk of loss does not necessarily stem from weak fundamentals.

- Second, risk can be present even without weakness in the macroenvironment.

- Third, risk is deceptive.

509

1.03K reads

Risk: Hard to formulate, measure or predict

- Skillful investors can get a sense of the risk present in a given situation. They make that judgment primarily based on (a) the stability and dependability of value and (b) the relationship between price and value.

- The fact that something – in this case, loss – happened doesn’t mean it was bound to happen, and the fact that something didn’t happen doesn’t mean it was unlikely.

- When markets are booming, the best results often go to those who take the most risk.

- There’s a big difference between probability and outcome. Probable things fail to happen – and improbable things happen – all the time.

503

665 reads

The Rabbit Hole Of Risk

- Risk cannot be measured. Certainly it cannot be gauged on the basis of what ‘everybody’ says at a moment in time.

- Risk can be judged only by sophisticated, experienced second-level thinkers.

- Investment risk is largely invisible before the fact – except perhaps to people with unusual insight – and even after an investment has been exited.

- Risk exists only in the future, and it’s impossible to know for sure what the future holds.

Only the things that happened, happened.

502

626 reads

The received wisdom is that risk increases in the recessions and falls in booms. In contrast, it may be more helpful to think of risk as increasing during upswings, as financial imbalances build up, and materializing in recessions.

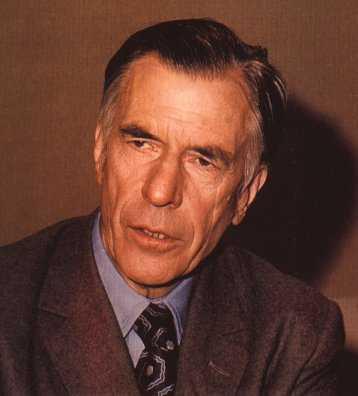

ANDREW CROCKETT

503

706 reads

Recognizing Risk

- No matter how good fundamentals may be, humans exercising their greed and propensity to err have the ability to screw things up.

- Great investing requires both generating returns and controlling risk. And recognizing risk is an absolute prerequisite for controlling it.

- Recognizing risk often starts with understanding when investors are paying it too little heed, being too optimistic and paying too much for a given asset as a result.

- High risk, in other words, comes primarily with high prices.

- Participating when prices are high rather than shying away is the main source of risk.

504

553 reads

Tolerating Risk

- Risk tolerance is antithetical to successful investing.

- A prime element in risk creation is a belief that risk is low, perhaps even gone altogether.

- Better safety gear can entice climbers to take more risk – making them in fact less safe.

- Risk cannot be eliminated; it just gets transferred and spread.

- Developments that make the world look less risky usually are illusory.

- The risk-is-gone myth is one of the most dangerous sources of risk, and a major contributor to any bubble.

504

499 reads

Controlling Risk

- Outstanding investors, in my opinion, are distinguished at least as much for their ability to control risk as they are for generating a return.

- Loss is what happens when risk meets adversity. Risk is the potential for loss if things go wrong. As long as things go well, the loss does not arise.

- Risk gives rise to loss only when negative events occur in the environment. The absence of loss does not necessarily mean the portfolio was safely constructed.

504

468 reads

The Value Of A Portfolio Manager

- The manager’s value added comes not through higher return at a given risk, but through reduced risk at a given return.

- The intelligent bearing of risk for profit, the best test for which is a record of repeated success over a long period of time.

- So in most things, you can’t prepare for the worst case. It should suffice to be prepared for once-in-a-generation events.

- Risk control is the best route to loss avoidance. Risk avoidance, on the other hand, is likely to lead to return avoidance as well.

503

446 reads

Being Attentive to Cycles

- Nothing goes in one direction forever.

- Rule number one: most things will prove to be cyclical. Rule number two: some of the greatest opportunities for gain and loss come when other people forget rule number one.

- The basic reason for the cyclicality in our world is the involvement of humans.

- When people are involved, the results are variable and cyclical. The main reason for this, I think, is that people are emotional and inconsistent, not steady and clinical.

506

463 reads

Investor Stupidity: The Three Stages of a Bull Market

- The first, when a few forward-looking people begin to believe things will get better.

- The second, when most investors realize improvement is actually taking place.

- The third, when everyone concludes things will get better forever.

What the wise man does in the beginning, the fool does in the end.

508

471 reads

Extreme Market Behaviour

it takes analytical ability, objectivity, resolve, even imagination, to think things will ever get better. The few people who possess those qualities can make unusual profits with low risk.

The oscillation of the investor pendulum is very similar in nature to the up-and-down fluctuation of economic and market cycles.

Extreme market behaviour will reverse.

502

445 reads

Combating Negative Influences

Why do mistakes occur? Because investing is an action undertaken by human beings, most of whom are at the mercy of their psyches and emotions.

The desire for more, the fear of missing out, the tendency to compare against others, the influence of the crowd and the dream of the sure thing – these factors are near universal.

Inefficiencies – mispricings, misperceptions, mistakes that other people make – provide potential opportunities for superior performance. Exploiting them is, in fact, the only road to consistent outperformance.

504

406 reads

Nothing is easier than self-deceit. For what each man wishes, that he also believes to be true.

DEMOSTHENES

503

634 reads

Avoiding Bubbles

To avoid losing money in bubbles, the key lies in refusing to join in when greed and human error cause positives to be wildly overrated and negatives to be ignored.

- Nobody has all the answers; we’re all just human.

- No strategy can produce high rates of return without risk.

502

457 reads

The Most Repeated Business Advice

- Buy low; sell high is the time-honored dictum, but investors who are swept up in market cycles too often do just the opposite.

- Once-in-a-lifetime market extremes seem to occur once every decade or so.

- Most typical of market victims: the six-foot-tall man who drowned crossing the stream that was five feet deep on average.

- Much of the time there aren’t great market excesses to bet against.

504

448 reads

Skepticism

- If you believe the story everyone else believes, you’ll do what they do.

- Only a skeptic can separate the things that sound good and are from the things that sound good and aren’t.

- Skepticism calls for pessimism when optimism is excessive. But it also calls for optimism when pessimism is excessive.

- Skepticism and pessimism aren’t synonymous.

- The key – as usual – was to become skeptical of what ‘everyone’ was saying and doing.

- The error is clear. The herd applies optimism at the top and pessimism at the bottom.

503

407 reads

Finding Bargains

The process of intelligently building a portfolio consists of buying the best investments, making room for them by selling lesser ones, and staying clear of the worst.

The raw materials for the process consist of

(a) a list of potential investments,

(b) estimates of their intrinsic value,

(c) a sense for how their prices compare with their intrinsic value

(d) an understanding of the risks involved in each, and of the effect their inclusion would have on the portfolio being assembled.

The starting point for portfolio construction is unlikely to be an unbounded universe.

502

386 reads

The Inevitable Mistakes

Since bargains provide value at unreasonably low prices – and thus unusual ratios of return to risk – they represent the Holy Grail for investors.

It’s obvious that investors can be forced into mistakes by psychological weakness, analytical error or refusal to tread on uncertain ground. Those mistakes create bargains for second-level thinkers capable of seeing the errors of others.

501

390 reads

Patient Opportunism

- Patient opportunism – waiting for bargains – is often your best strategy.

- You’ll do better if you wait for investments to come to you rather than go chasing after them.

- An opportunist buys things because they’re offered at bargain prices. There’s nothing special about buying when prices aren’t low.

- We don’t look for our investments; they find us.

509

397 reads

The market’s not a very accommodating machine; it won’t provide high returns just because you need them

PETER BERNSTEIN

500

470 reads

To Invest Or Not Invest

- One of the great things about investing is that the only real penalty is for making losing investments. There’s no penalty for omitting losing investments, of course, just rewards.

- The dumbest thing you can do is to insist on perpetuating high returns – and give back your profits in the process.

- You simply cannot create investment opportunities when they’re not there.

- If it’s not there, hoping won’t make it so. Wishing won’t make it so.

- You want to take risk when others are fleeing from it, not when they’re competing with you to do so.

501

365 reads

We have two classes of forecasters: Those who don’t know – and those who don’t know they don’t know.

JOHN KENNETH GALBRAITH

501

462 reads

Appreciating the Role of Luck

Every once in a while, someone makes a risky bet on an improbable or uncertain outcome and ends up looking like a genius. But we should recognize that it happened because of luck and boldness, not skill.

The truth is, much in investing is ruled by luck. Some may prefer to call it chance or randomness, and those words do sound more sophisticated than luck.

A great deal of the success of everything we do as investors will be heavily influenced by the roll of the dice.

501

368 reads

503

521 reads

IDEAS CURATED BY

CURATOR'S NOTE

Successful investing requires thoughtful attention to many separate aspects, all at the same time. The Most Important Thing by Howard Marks covers these key aspects in layman language and without a lot of finance jargon though it covers the concepts of investment theory.

“

Curious about different takes? Check out our The Most Important Thing Summary book page to explore multiple unique summaries written by Deepstash users.

Logan 's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to make good decisions

How to manage work stress

How to manage email effectively

Related collections

Different Perspectives Curated by Others from The Most Important Thing

Curious about different takes? Check out our book page to explore multiple unique summaries written by Deepstash curators:

4 ideas

155 ideas

16 ideas

Discover Key Ideas from Books on Similar Topics

7 ideas

Margin of Safety

Seth A. Klarman

4 ideas

Investing in One Lesson

Mark Skousen

8 ideas

5 Differences between Investing and Trading

motilaloswalmf.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates